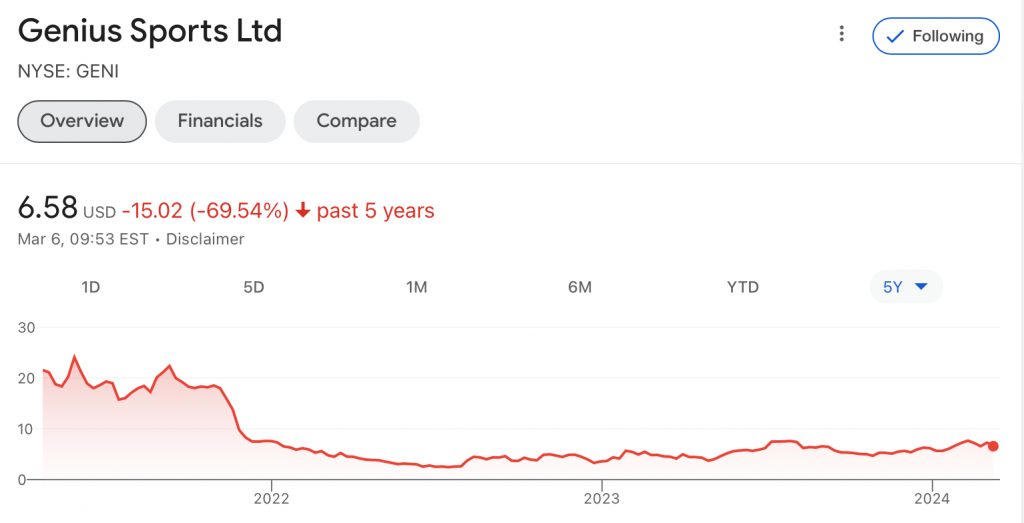

Genius Sports announced their results this week and the share price dropped 7%. It’s 70% down on the 5-year chart.

Sportradar is also down, close to that (c60%).

IMG Arena, part of Endeavor, and the third big competitor in sports data, is now basically an unwanted asset, on the block, in the context of the rumoured break-up of Ari’s company. It’s been quietly folded into Openbet since losing the key ATP rights to Radar.

Sometimes you need to call things as they are!

The sports data sector is now a dog. You have to overpay to “rent” rights for only a brief period, and give away equity in your company to secure that deal. That whole model is dead, like it is for broking sports broadcast rights. We live in an IP ownership world, and renting rights is not a business I’d recommend any capital gets behind.

And that’s what any serious corporate financier or CFO will likely say. They will look at the macro situation of a sector, and its companies, and have an opinion on the asset class. That’s what they get paid for.

A financier is not an accountant.

Yet, some people are yet to understand the difference.

The age of the financier is coming to a close.

The era of finance is not coming to a close, it’s just at a Fourth Turning, about to enter a period of intense evolution.

Those who understand that, and can position themselves to take advantage, by recalibrating their risk management, by deploying their capital in the right way, are going to do very well. Money is always made at each Turning, especially the fourth one.

In simpler language, now out of fashion, it was called the business cycle.

These are going to be extraordinary times for all of us, and whether one likes it or not, the master of the universe will remain the finance guy. They’ll still be the smartest and most influential person in the room, just probably dressed a bit differently going forward.

To be fair to Mr Garrett Johnston’s letter, he’s not the only one who thinks like he does. The FT Business of Football Conference had some golden soundbites.

What’s the problem with private equity funds? Do they know anything about football? In my view, they don’t. Clubs should simply go to a bank if they need money,

Aurelio De Laurentis – Napoli FC

As quite a severe critic of some PE deals into sport, this should be a lay-up for today’s Column. An open goal. But that’s too easy, and would be wrong. Baby and bath-water stuff.

De Laurentis, who is normally bang on with most things, is being characteristically bombastic. Maybe understandably so, given the deals out there these days. But we shouldn’t write the financier types off just yet.

The fiercest critic is often best -placed to be generous and fair. The boys and girls of Big Finance are not “just a bunch of jumped up accountants, with little understanding of business, technologies, and customers.”. They are very sharp and astute, and more importantly, adaptable, where the very best ones will feel the music changing ahead of the pack.

Like chameleons, financiers change colour.

Depending on the environment. Like elite ballroom dancers, they change their performance depending on the music they hear.

And rest assured, whilst the music’s playing, they are always on the dancefloor.

The Sportbiz, is going to have to keep up and climb a steep-learning curve to handle the coming new era of money. Big Finance isn’t going anywhere, regardless whether sport is or isn’t considered a business.

Everything always needs to be financed, and sport absolutely needs fresh capital. But the story of the last 10 years is that the tango between these two has been less than impressive. Neither side really understands the other. Sport outside the US is not the simple homogenous asset class the investment bankers think it is, and the capital markets of finance are not always as negative and ruthless as the “blazers” believe.

Sport, in fact, is lucky that many people with capital still consider it an attractive non-correlated alternative investment class.

Just because you don’t understand something, doesn’t mean it’s bad or wrong.

It just needs to be better explained.

At an event in Howden London to present “Sport’s Perfect Storm“, the host Elliot Richardson astutely asked why I always say that many PE deals in sport are doomed to disappoint. Elliot is someone with a profound knowledge and direct experience of how PE operates.

What advice or diligence are they missing, Rog?

It’s exactly the right question. What are they getting wrong?

The event recording is an “AYNE” special show and can be found here.

There is one dominant reason above all, and we will get to that later, but the answer is layered and complex, and needs full context.

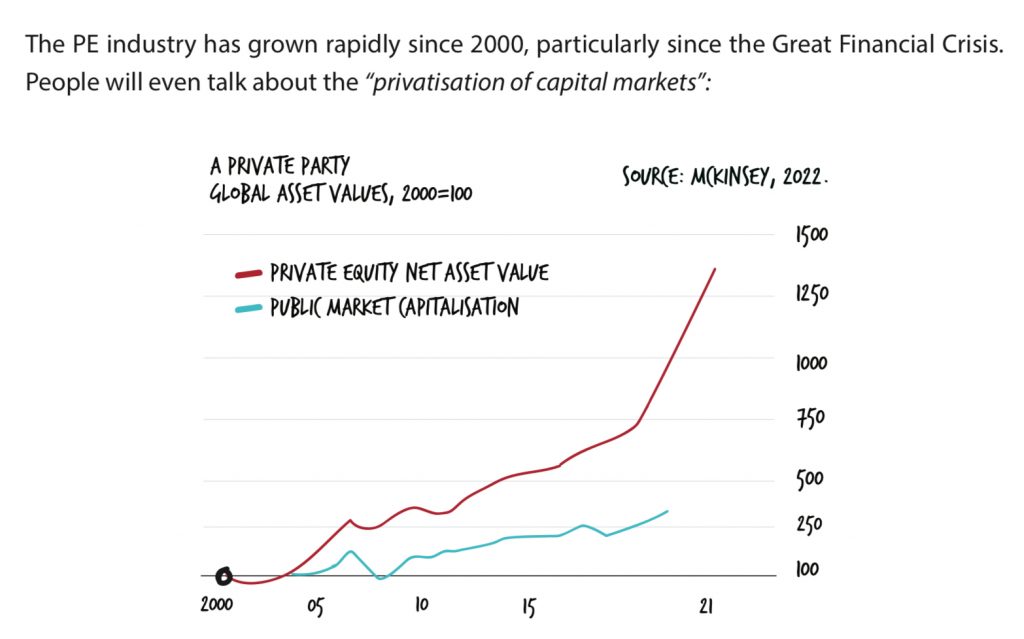

The book spends many pages discussing the rise of private equity (PE), and venture capital (VC), compared to the traditional listed public capital markets. Today’s Sunday Column doesn’t have the space or desire to substitute months of work and detail of the Storm, but if some people think “the age of the financier is drawing to a close”, then, we should remind ourselves of a few basic things.

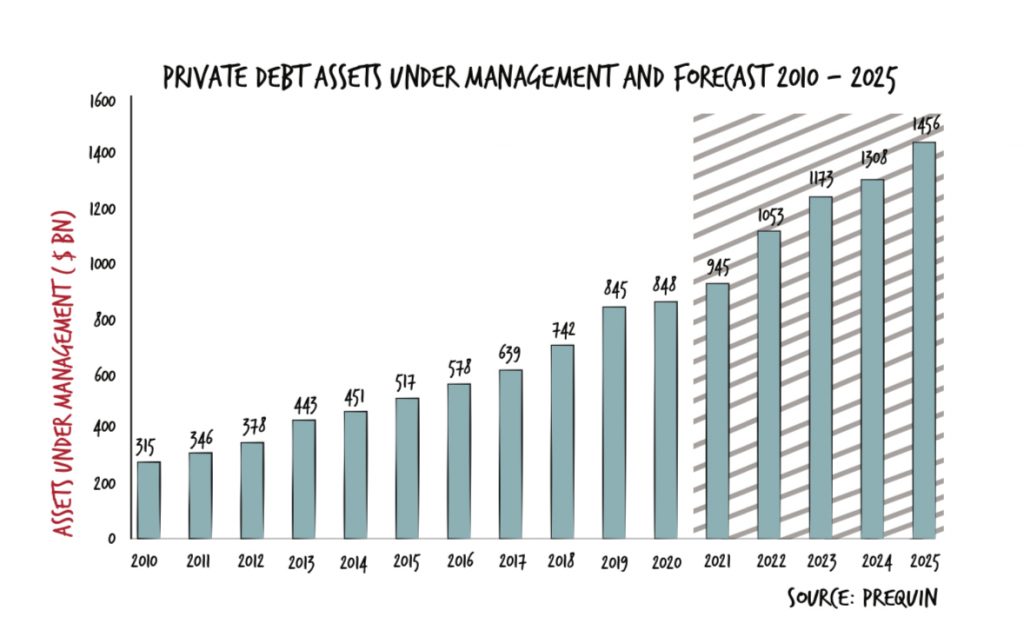

Business, wealth management, and finance have all been utterly changed and defined in the last generation by the rise of VC and PE. It’s not the passing fad, like NFTs or crypto shitcoins, that some people hope it is. Our world has been, and will now always be, shaped by venture and private equity.

VC and PE are very different beasts.

Venture capital, the Silicon Valley playbook, has delivered almost all of the growth, innovation, and new wealth creation in these last 20 years. The new tech they funded has empowered the digitalisation of our entire world, and created entirely fresh models for product, distribution, and valuation. It has worked by telling founders and start-ups to pursue growth, scale, and new users at all costs, with the implied promise that they’d always fund their next capital round to cover the losses in doing that. And that worked beautifully, until it didn’t, about 18 months ago. The money dried up as interest rates increased.

Now, so many companies, the engine of the world’s innovation, are orphaned in no-man’s land, not yet a profitable business, but without ongoing access to fresh capital to fund losses. That alone is a dramatic set of affairs that will inform the next few years on the markets, and in the Sportsbiz.

Sport has outsourced all R&D to venture capital.

Sport has never done innovation on its own. Firstly, it doesn’t have the mindset and skills; secondly, it puts a premium on tradition and the old way of doing things. It has outsourced its R&D lab to sportech start-ups, mainly of whom are now struggling. Where next for an industry that really does need to innovate? Who will do that, and who will fund it?

This question in itself is worthy of a future Column, one Sunday in late Spring.

Today’s Column is about PE’s “jumped-up accountants”.

I’m just not having that description. Yes, they have many faults and sins, but “he, without them, can throw the first stone“.

There is a specific chapter in “Sport’s Perfect Storm” called “Finance is not Accountancy”, to address the confusion people have between the two. Almost all corporate financiers have some form of accountancy training, but not all accountants are serious financiers. Let’s be very clear on that difference:

Accountants keep score on value, and comment on what someone else does.

Financiers proactively create value for providers of capital.

In the same way that sports hacks keep score and comment on what someone else does, when owners, managers, and athletes are the actual protagonists of our games. We never equate a scribbler at the Mirror with Kevin DeBruyne, so don’t confuse a book-keeper with an investment banker.

PE deserves our full attention and respect because, in pounds shillings and pence, they have absolutely delivered a return, for both investors (LPs) and for themselves (GPs). And it would be a foolish person who generalised them as ‘spreadsheet jockeys’ who, in some implied way, don’t deserve their success, and only got lucky with a process of vulture opportunism and debt leverage.

These people see opportunities, are intellectually intimidating, don’t suffer fools, or bullshit-bingo-bluffers. One needs to raise one’s game when meeting them.

Private equity has changed the world.

Accountants haven’t.

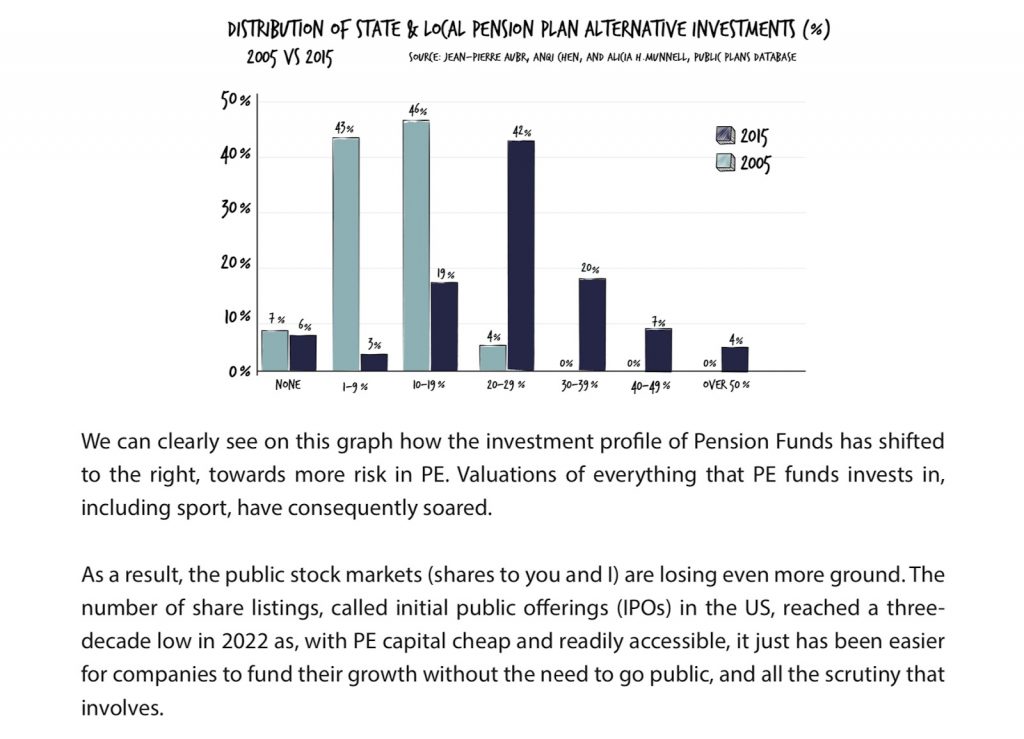

Few understand how this happened. There are a lot of savings, pensions, and wealth in global markets, and the bulk of them in the last 20 years has ended up in a PE fund. Just luck?

Remember, in the old days, the ultimate aspiration of a company was to get listed on the public stock markets. The glory of getting to ring the bell on Wall Street. You had made it.

No longer.

The higher returns offered by PE have totally altered our markets, as savers and investors have just done better investing capital in private equity and debt. That’s a whole new world from when I started working in 1983, and has major implications.

Private equity is now everywhere.

Some rough-sea imagery from “Sport’s Perfect Storm”:

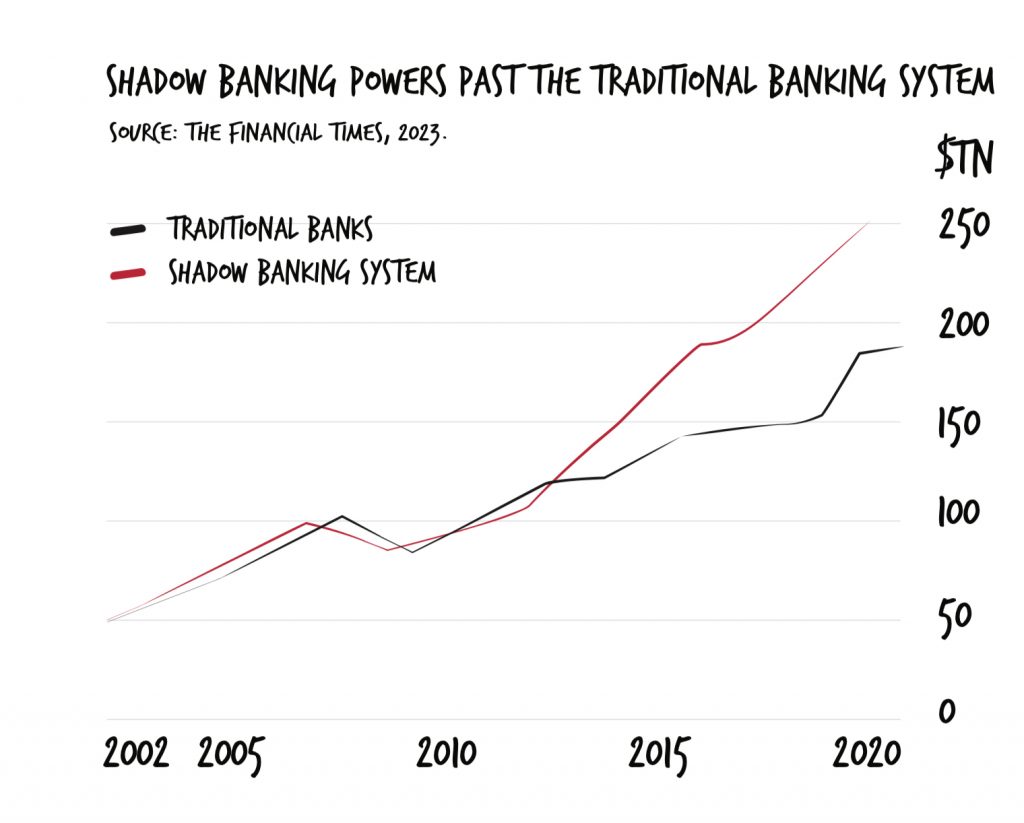

The vast majority of capital in today’s markets is neither traditional nor public. It’s in the “shadows”, often called “alternative”, and these are vast pools of basically unregulated money, making very significant bets on complex financial assets and instruments, and their “derivatives”.

People have no idea of the huge numbers involved, what is actually going on, and the enormous risks now baked into our world. They don’t understand the amounts of debt that governments and companies need to roll-over in the next 2 years. They don’t understand fractional reserve banking, or the trillion-dollar deficits being run up each year in the USA.

So they see very little of the risk that is just waiting below the surface of the waves.

Goodness, even your garden-variety accountant could do the sums on how the Western governments are drowning in debt, facing a demographic cliff on pensions, and basically bust. With various hefty bills coming through the letterbox in the next 5 years.

Yet people say…

The age of the financier is ending.

What naive nonsense. Utter tosh. Laughable.

The “financier” will be the protagonist.

Watch how the “financier” really becomes central to your lives when all this starts to unravel. A lot of underpriced risk is going to come at us very very fast. And “too big to fail” won’t cover it, this time.

You will just not be able to work at the top end of any business if you haven’t a pretty decent understanding of what drives the mentality of the people that will be financing your government and your workplace. And they will in some way all be PE guys. Have a look at who owns most of the housing stock in the US.

So everyone needs to know how these people think and react. How they will adapt to a fourth turning.

In the simplest summary acceptable for a Sunday morning read, here is how PE works.

[ The financial engineering bit ]

You load up the business with cheap debt to lever equity returns exponentially. Study an old Greek maths guy called Archimedes.

Debt works so well in corporate finance that it begs the question, why not use it as much as possible. This is in fact a crucial debate in finance, all covered in chapter 17 of the book.

Don’t just ask yourself why the new Apple sports app is so bad; where the Vision Pro functionality fits into sport broadcasting. Ask yourself why Apple is buying back its own shares, and why they are still valued so highly when so much of their business (like Chinese market share) has gone ex-growth.

You think you don’t need to know all that? Wrong.

[ The operational improvement bit ]

You invest in an established business with profits and cash flows, where you think you can improve its operation efficiency. Better management, synergies, cross-fertilisation, cost savings. You take a good, but flabby, asset and get it into shape. This is not banal, and you need to know what you’re doing. Normally the PE guys will take a lot of advice here, understand the sector, its levers and models, then find a top CEO to deliver change (giving them massive financial incentives). This is not financial engineering. This is just good business.

PE in these ways hope to deliver returns aimed at 25%, even unlevered, and that’s why so much of the savings of the world end up in these funds now. Your own pensions are in these vehicles.

Simply, PE has delivered very high returns.

And been very lucrative for the fund managers (GPs). The model of private equity funds is one of the most attractive businesses you can ever find. You use someone else’s capital (equity and debt) to make your plays, and you take a fee of 2/20.

2% annual management fee on the size of the fund, and 20% of the excess of profits above the expectation.

So the best and brightest work in finance.

Coming back to the question of Mr Richardson, what has PE, with all these brains, missed in sport? Why have they not yet managed to make it work? Why are people like the Napoli owner so scathing?

The first thing to say is that it is not always all the fault of PE. For example, the case for the defence of CVC and rugby would be something like this:

i.

They did roll up their sleeves and try to bring in superior operational expertise.

Darren Childs and Simon Massey Taylor were hired.

ii.

They made major assessments on where media values could go, if less fragmented, using the best industry experts. They weren’t just pulling numbers out of their behind.

iii.

They looked at removing agency margins by doing the broadcast deals themselves.

iv.

They made serious investment in fan data and systems.

v.

They haven’t messed around too much with “financial engineering” as you can’t really do that on minority stakes, aside from the dividend streams. CVC in rugby hasn’t been like the Glazers at United.

Rugby was flabby, and needed new thinking.

CVC saw a deal opportunity, and was prepared to go for it.

What they have gotten wrong is in overestimating the stakeholders in sport, especially the ego and selfishness of club owners and federation committees. These are often not rational people, and if they are, they are never aligned in the same direction. Herding cats.

All of us who have worked in that commissioner CEO job know this, but the true extent of the difficulty can’t be perceived until you’ve been in the role. We feel for Richard Masters, who is clearly losing the dressing room now. The EPL is showing cracks in the walls. Too many new people, with vastly different ideas.

John Textor, a multi-club owner (MCO) at that same FT conference called (paraphrasing) for the Premier League spending rules to be relaxed — or ditched altogether — so that rich owners can pump their own money into clubs and cut the gap with the top teams. On the very same stage Gerry Cardinale of Redbird and AC Milan said basically the complete opposite, that professional investors should be ashamed of the financial state of play in European football:

We have to be more self-sufficient, we have to be able to run these things more professionally.

He said calls for new competitions, such as the European Super League, were a “distraction” from years of mismanagement across the game, adding:

Let’s own ourselves better. The fact that these things trade on a multiple of revenue is pure laziness. Shame on all of us. These things should trade on a multiple of cash flow. Deficit financing yourself, and blowing your brains out in the transfer market, all this stuff has to change.

Wow.

This is the quality of investment banker intellect mentioned above. Gerry is spot on and it all HAS to change.

But even he couldn’t reconcile the whole Maldini issue, and that’s cost him. European football is a really tough gig. As a sector, it’s bleeding cash every day.

Rowing in the same direction is impossible.

Sport and its governance, its ego-driven owners, its traditions, are all impossible to get working in the same direction. Surely that is abundantly clear? And it is just a very bad set-up for a PE industry that works best with stable cashflows around low BETA business.

Sport in Europe is neither stable, nor low BETA.

So doing good deals in sport as an investor isn’t at all about being “spreadsheet jockeys” good with numbers. It’s about assessing the marginality of entire sectors and business models, reading the room for irrationality, and hearing the music of tomorrow. And being quicker to adapt than the next guy.

There are three ways to win in this business. Cheat, be smarter, or be first.

– Margin Call

Be first is the way. See things earlier and adapt. Be a better chameleon.

So far in our industry PE has not read the room so well.

PE has overestimated sport’s common sense.

They have been too naive in underestimating what we should call “stakeholder risk”. When the product is about passion, and beating the next guy, people dont tend to make the best decisions.

Investing in the various rights owners of rugby, or in the football leagues of Europe, is not like investing in an organisation like F1, where there is one governing body, and a very much simpler governance, with a clear line of sight on decision-making.

CVC believed in what they were told about how their money would be spent by rugby. And maybe the deal fatigue just wore them down, making them a bit lax on controls around those Use of Funds.

Managing sport, herding those cats, does wear you down, and, in the end, many hold their nose and hope for the best, as they get seduced by the adrenaline and fame.

So the trick is in knowing where the governance of sport is so bad as to preclude even starting due diligence.

Learning when to say no, is the absolute key to great investing.

Some sports deals are just not suited to PE.

Say No!

This is the very clear conclusion. Once you see that, life becomes easier.

In theory, and in the simplest terms, PE is bringing forward the media revenues of tomorrow, to invest in the infrastructure of today. New stadia, new commercial strategies, commercialisation, new models of business like DTC.

There are two major problems of principle with that:

1.

PE funds need to get in and out of that investment quicker than the timeframe needed to turnaround the sport. You can’t do it on a 7-year timeframe, and it would need longer-dated fund structures or different special purpose vehicles (SPVs) for the longer term.

2.

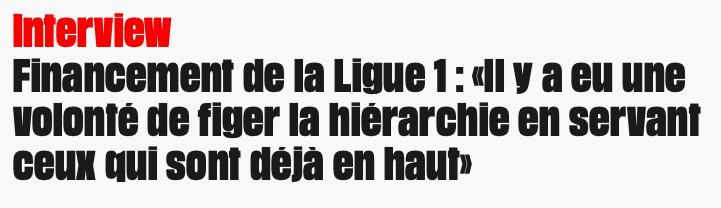

With open leagues, where membership and shareholders are constantly changing, the idea of accelerating revenues forward (to benefit today’s teams over tomorrow’s) is intellectual incoherence of the highest order. You can’t credibly and fairly do it. You are taking the dowry of future clubs in your league to give to the lucky ones of today. Personally, I can’t understand why this isn’t spoken about enough. It’s actually stealing from tomorrow’s future promoted clubs. Ask Le Havre, apparently suing the French league over the CVC deal.

Sport and finance have made a colossal mess of these things in recent years, by trying to put a square peg in a round hole, and some of the debris is now surfacing in plain sight. For example, Australian rugby.

Silverlake and the AllBlacks similarly has not worked, once again through underestimating “stakeholder risk”.

Deals in sport need realism and tight process.

Sport, as an asset and a set of cashflows, is often too volatile, too emotional, and too correlated to the media sector, for PE to get the quick return it needs. Not a good fit in the first place, and then the full “stakeholder risk” is underpriced. Underestimating the “known unknowns”, and especially “unknown unknowns”.

Fans opinion is absolutely a “known unknown”. They will never allow a PE deal in Germany. Another square peg in a round hole. What a waste of time.

Finance and Sport can be a good partnership.

With the right assets, structures, patience and discipline.

Investing big money into European sport can be done well, with proper risk management around how you invest, at which part of the Balance Sheet, and with which covenants. Look how Paul Singer’s Elliot placed itself around lending to the Chinese owners of AC Milan, and then look how LionRock (and now OakTree) lent money to Inter Milan. Look how the new investor into the old Federation Cup structured the deal, advised by our friends at OakWell Sports.

And look how Sir Mike Moritz took new capital into the PTO alongside the athletes.

Here is the real answer to Mr Richardson’s question.

Today’s PE funds and investment banks NEED to deploy capital and get deals done, as no-one wants to give money back to LP investors. That’s the cardinal sin.

So they are convincing themselves that the numbers can work in their short investment timeframe, they are convincing themselves that open leagues are appropriate vehicles for the capital, they are convincing themselves that “shareholder risk” is contained and manageable.

Because they want to say yes to a deal, to a lot of deals. That’s the inconvenient truth. Show me the incentives and I’ll show you the outcomes.

Charlie Munger is always the real answer.

There are now too many PE funds bidding on the same deals, overpaying in the auction, guaranteeing lower returns, and that is all destroying their own fantastic model of success.

They are saying yes to these bad deals because they need to deploy capital and earn fees!

Sport absolutely needs finance and capital. But it needs an old style of long-term relationship banking, investing and lending smartly across the Balance Sheet. It needs a return to a merchant bank mentality.

These old blue-blood investment houses were normally a partnership, investing their own capital, and, given that, were damned careful to whom they lent. They were risking their own money, and reputation, so the old wise merchant banker, partner in his firm, always looked for reasons to say no to a deal. They couldn’t afford mistakes.

Note the difference. Looking to say no, as opposed to being desperate to say yes.

In a previous turning in the world of finance, 1980s deregulation, all these old UK merchant banks were bought by mega American investment banks, and their prudent culture was utterly subsumed. The parallels between this, the City’s Big Bang, and what Clearlake/Boehly has done to Chelsea, is ironic.

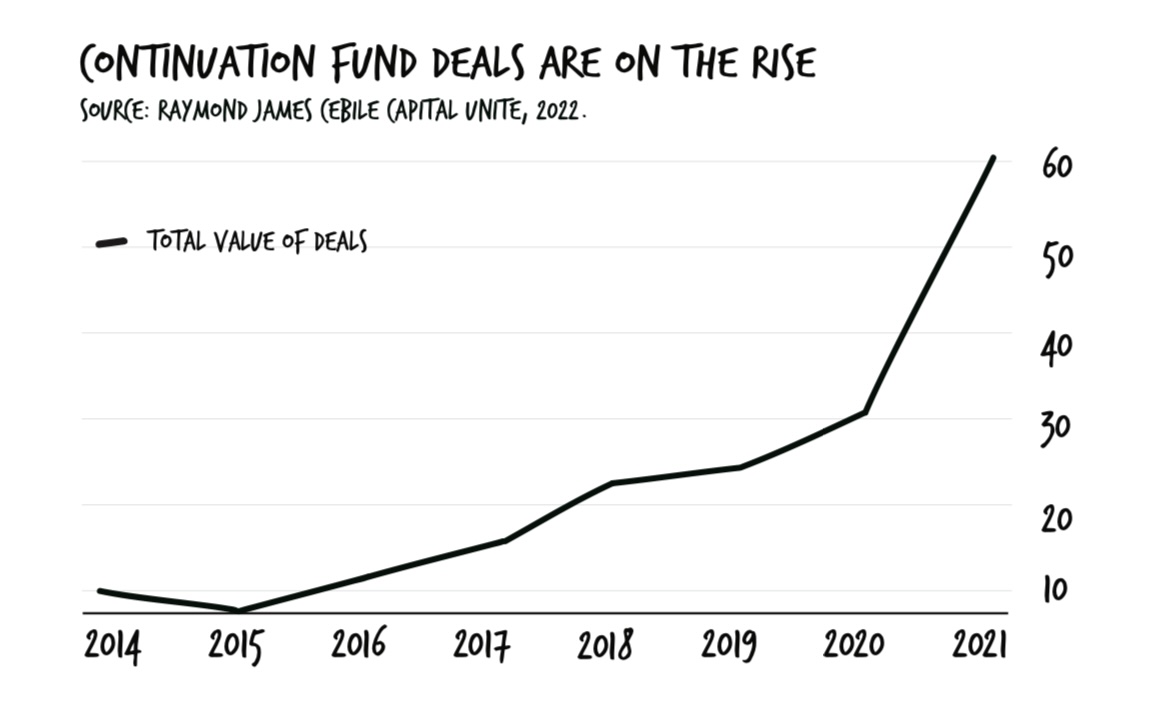

Many of today’s PE deals will be loss-making.

And not just in sport.

But we will never ever be told. Private equity is very much private. Not public, like Genius or Radar, who get hammered on the listed markets in real-time.

PE funds instead can say very little, and even exchange bad investments between each other, so both firms can kick the can down the road on mark-to-market. Or, simply, they will set up a new vehicle, called a continuation fund, to sell the bad asset to themselves.

Continuation funds have become rather popular.

Why do you think that is?

That’s why the age of the financier never ends. They always find ways to adapt and survive. To camouflage themselves.

Don’t be ill-prepared for what is coming. All the bad news that has been brushed under the carpet, all the cans that have been kicked down the road, are now upon us.

Be ready for the Storm.

To order the Limited Edition of Roger Mitchell’s book “Sport’s Perfect Storm“, click here and fill the form.

Listen to our “Are you not entertained?” sports management podcast here.

To find out what we do in change management, have a look here.

For our C-suite management services, read here.

Here you can know more about our content development work.

Discover our Corporate Learning service.

Get to know more our “Sport Summit Como” yearly sports management event here.

If you are interested in our own story, check us out here.