I have a very soft spot for IMG.

My first experiences in the industry were working with Graham Fry on Italian football. I later used them as advisors at the Scottish Premier League with Andrew Croker and Jonty Hill. I got them to invest in GiveMeSport with Ben Nicholas. We sold IMG Arena the Pixellot AI cameras.

Rog, the IMG that you knew no longer exists.

After three days in London, where everyone gossips like this, the break-up of Endeavor/IMG is the subject of today’s Sunday Column.

M&A Chops.

In the late 1980s I was employed as a grunt on a mergers and acquisitions (M&A) team in the City of London. Work was varied, as bosses threw ideas and annual reports at you, en passant.

Have a look at Croda PLC. It’s a mini-conglomerate and I think it’s undervalued. Do the analysis and numbers by tomorrow and give me your view on break-up value and who is buying what.

End of brief.

Most M&A work isn’t really about numbers, but actually imagination and vision, like some kind of puzzle or problem-solving.

I worked at James Capel, one of the oldest (1770) and most historical of blue-blood brokers in the Square Mile. They were particularly famous for the quality of their equity research department, where their superstar-analysts regularly won the annual awards.

So, any enterprising interloper, in a world not their own, would always do well to befriend those analysts and pick their brains, over some bubbly you offered. You’d go to the guy who covered speciality chemicals and get the low-down on Croda.

Whispers and Walls.

Oh really? Is it in play now? What’s going on?

That information would then, perhaps, reach the sales desks. The City back then existed in exactly this currency of velvet whispers, sitting atop porous Chinese walls.

Joe Lewis, of Tottenham, would understand the game.

All that suited a Glasgow outsider like me, who had a brass neck and made friends relatively easily.

As a Scottish CA and auditor, who knew a Balance Sheet and creative accounting better than most, I got a lot of these assignments before many of the Oxbridge Hooray Henrys, with zoology degrees, who bluffed a wage worked in investment banking.

I spent most of my time with these elite analysts and from them I picked up proper strategic corporate finance, as opposed to book-keeping accountancy. They opened my eyes to how serious capital looked at “value” and constructed a narrative around growth, via M&A.

This is handy, as we are now in a world of inorganic growth, doing deals.

These analysts no longer exist, and that’s tragic.

The cost to produce their amazing reports (seven-figure salaries) were paid for by sales commissions, trading big blocks of shares. The analysts’ output created stickiness for using Capel to make your trades, and it was the understood quid pro quo.

Just like the creative directors in an ad agency, like big name journalists on broadsheets, the analysts really built “brand” and sprinkled stardust, for a bigger business model that actually made the money. Now, with automatic algo trading, and passive ETF investing, those commissions are gone, and so are those amazing analysts.

No one pays for content in this unbundled world.

For a few months now, our sector has heard a germain version of one of my old James Capel briefs.

Have a look at Endeavor Inc (EDR). It’s an entertainment conglomerate and I think it’s undervalued compared to its breakup value. Do the analysis and numbers by tomorrow and give me your view.

EDR is a diversified group of assets, services companies and IP, operating across the media, entertainment, and sport sectors. It includes IMG.

It listed on the public markets in March 2021, and crucially the share price has gone nowhere since. People and investors see the stellar price increases at the seven mega stocks (Magnificent 7) like Apple, Nvidia, Microsoft, and get twitchy. They start asking questions.

Where’s mine? Where’s my Maserati?

This is my world, I’m a corporate financier at heart.

In bull markets, when everything seems to always be going up, CEOs will focus on growth, market-share, and revenues. When times get difficult, and share prices stagnate, the thinking changes, especially for conglomerate groups like EDR.

You can still create shareholder value with no organic revenue growth, by imaginative strategic thinking, strong cost control, and M&A.

Cool Kids and Nerds.

Good operators know well what has actually been happening for a while, to cause all this angst.

In a word, the stock markets are now polarising aggressively into Hollywood and Arthouse equities, just like the rest of our world, like politics, and like sport.

In short, in a world of automatic algo trading, the savings of investors have gone more and more into only a handful of megastocks, and this is a major problem, whose causes and implications go way beyond this Column.

Suffice to say that EDR isn’t one of those big 7 stocks being automatically propelled higher by this passive ETF investing.

The Truth about Valuation.

Truth About Valuation is chapter 21 of my book “Sport’s Perfect Storm” and is entirely dedicated to the realpolitik of asset valuations and investing for value. The chapter opens like this.

Chapter 21 is a very detailed read, but its summary framework is useful to discuss the under or over valuation of EDR.

Markets are driven by FOMO and glory, so there are no rights and wrongs about guessing what value really is. The game is to anticipate the direction of investors’ sentiment, and create a narrative.

It’s Eddie Murphy in “Trading Places” explaining why pork belly prices will go down running up to Christmas.

This right here is why M&A isn’t ever about spreadsheets that calculate “intrinsic value”. That’s the science, but the fun stuff is art.

In fact, in these days, so many metrics tell us that the low cost of capital has pushed the prices of equities, housing, sport franchises, beyond any numeric justification.

It’s called the Everything Bubble. And yet all of them still remain in high demand.

Valuation is actually about supply and demand. So when there is always a “greater fool”, (Eddie Murphy’s “suckers”), ready to bid prices even higher, asset markets can stay irrational longer than you can stay solvent.

Art is by definition irrational. As is finance.

A good financier doesn’t ever judge “value”, he/she just takes advantage.

Is EDR better broken-up?

So, are the public capital markets currently undervaluing EDR, and what should the current major shareholder (Silverlake), and management do about it? If EDR is not loved, like the Magnificent 7, should they maybe take the company private? Break it up?

If sentiment is negative, don’t fight it. Figure out why and work out a plan to unlock value.

Sport is a results-based shortermist industry, and that is a horrid mismatch for public markets, where you need to consistently beat The Street every three months in your reporting. The last thing you want, if you are in an industry turning its business model upside-down, is to be having your homework marked every quarter.

Additionally, people are asking if the conglomerate model of EDR – a combination of diverse assets under one roof – is actually more of a burden than a flywheel. What is called the “conglomerate discount”. We covered conglomerate thinking and theory in the LVMH article.

Smart people think that Endeavor is undervalued.

Really? I am not so sure. So, like one of those dreadful self-indulgent “letters to my younger self”, I thought I would have a look at Endeavor Inc (EDR), like in the old days, but with the older eyes of today.

As with any brief, it’s wise to always take a moment to understand what is actually being asked. You’ve been given little time to respond, it’s complex, and one could panic. Don’t.

In this case, the boss isn’t looking for a definitive answer, but an opinion (green/red light) on whether to dedicate more time to a potential fee-earning project. In other words, is there enough of a pricing mismatch to make it worthwhile to do some more real work? And get a client excited on a deal. You don’t need to write “War and Peace“.

You will start by really understanding the company, but, these days, you won’t find any of those magnificent old James Capel reports. You’ll need to do it all yourself.

Study the last annual report.

Annual reports and the notes are full of great information, if you know where to look. It’s really a novel that will give you a strong idea of the history and plot lines of the business.

And its health.

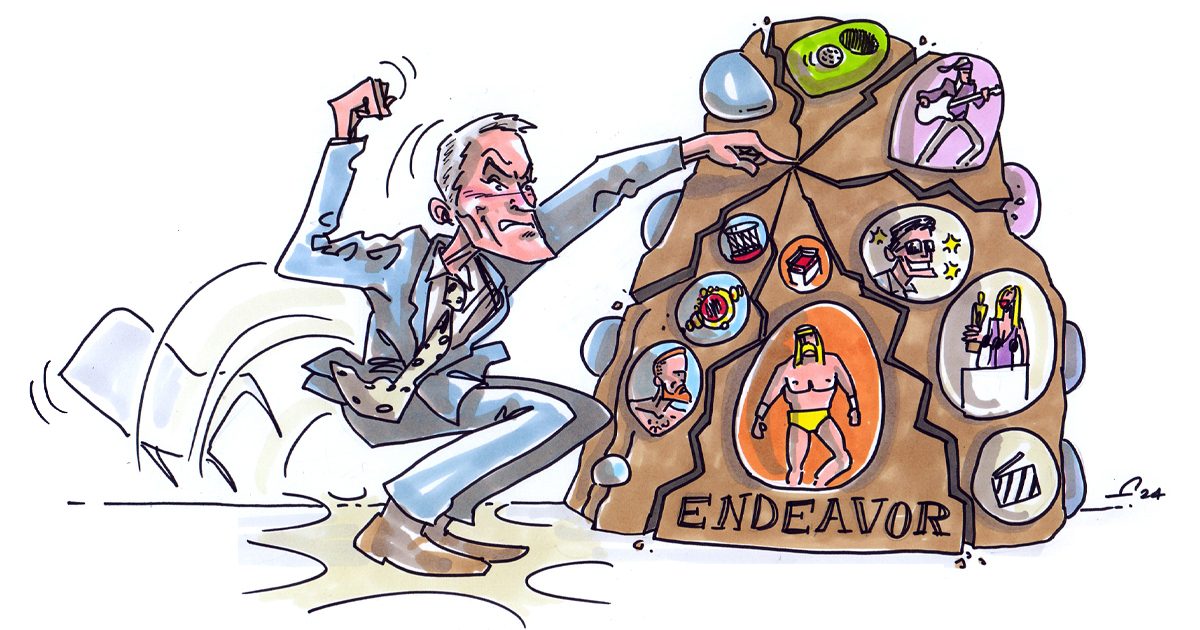

From its Hollywood talent agency roots (William Morris), EDR expanded into sports ten years ago with the acquisition of the iconic sports agency IMG. In 2016, it then made the significant strategic leap from being just brokers and agents, to buying sport IP in the first person, via the UFC. Last year, the UFC was merged with WWE and spun off into a new company called TKO, of which EDR holds a controlling 51%.

So, today, EDR includes talent agencies, event/hospitality, branding/advertising, movie financing, streaming technology providers, production companies, data/betting operators, rights brokers, and especially sport IP. This is undoubtedly a bellwether stock, something that dictates a sector.

That’s important for corporate finance, especially for big strategic bidders who want to become relevant overnight.

Endeavor seems to be everywhere, and it is.

EDR and its management helped to launch the top sports investment bank Raine, with Mubadala, Forstmann, and SoftBank Group as investors. Today Raine is central to the entire asset class. An octopus, like a Goldman Sachs for sport.

EDR has been assembled, via Silverlake private equity capital, by CEO and Chairman, Ari Emanuel and Patrick Whitesell.

Emanuel, aggressive high-octane ebullient, is an exceptionally talented top executive, and what one would call a bit of a character. He is the inspiration for Ari Gold in the hit TV series Entourage.

I, personally, can not recommend this series highly enough, (and choosing the best video to include here was actually a major challenge). The performance of Jeremy Piven as Gold is a rare treat.

Emanuel, as we can clearly see, is characterised as liking volatile energy and action:

We built a culture where people are rewarded for taking risks.

To use a cricketing metaphor, he is undoubtedly a front foot player going after the bowling, like Viv Richards in his pomp.

Ari aside, it doesn’t take a genius to work out that the main plot line of the EDR novel is actually about a strategic shift into owning IP, away from its traditional talent and rights broking business. Indeed, it is common currency in the sports sector to agree that the old intermediary model is now unattractive, losing marginality, too heavy on minimum guarantees, where the old three card trick of bundling rights and talent can no longer hold.

This is the key takeaway from studying the annual report. Miss that bit and you’re toast. And you’d deserve to be.

What are the numbers hoping to tell us?

Whilst Chapter 21 discusses all this in detail, it’s not the type of hard-yards grind for a Sunday morning article, so let’s do the light-touch desktop review for you.

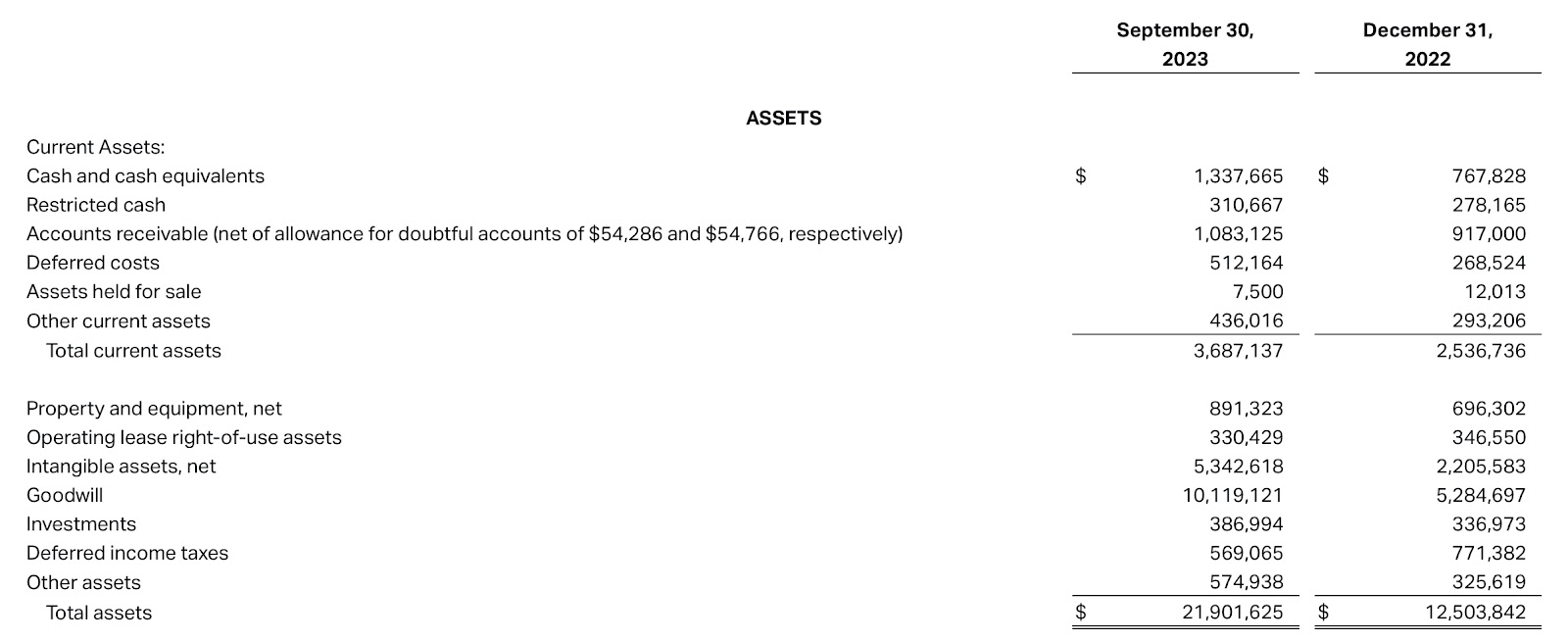

The book assets of EDR, in the Balance Sheet, carry a huge amount of fluffy intangible stuff.

There is $15bn in “goodwill and intangible assets”, out of $22bn of total assets.

Cough! It’s an IP business, so that’s ok!

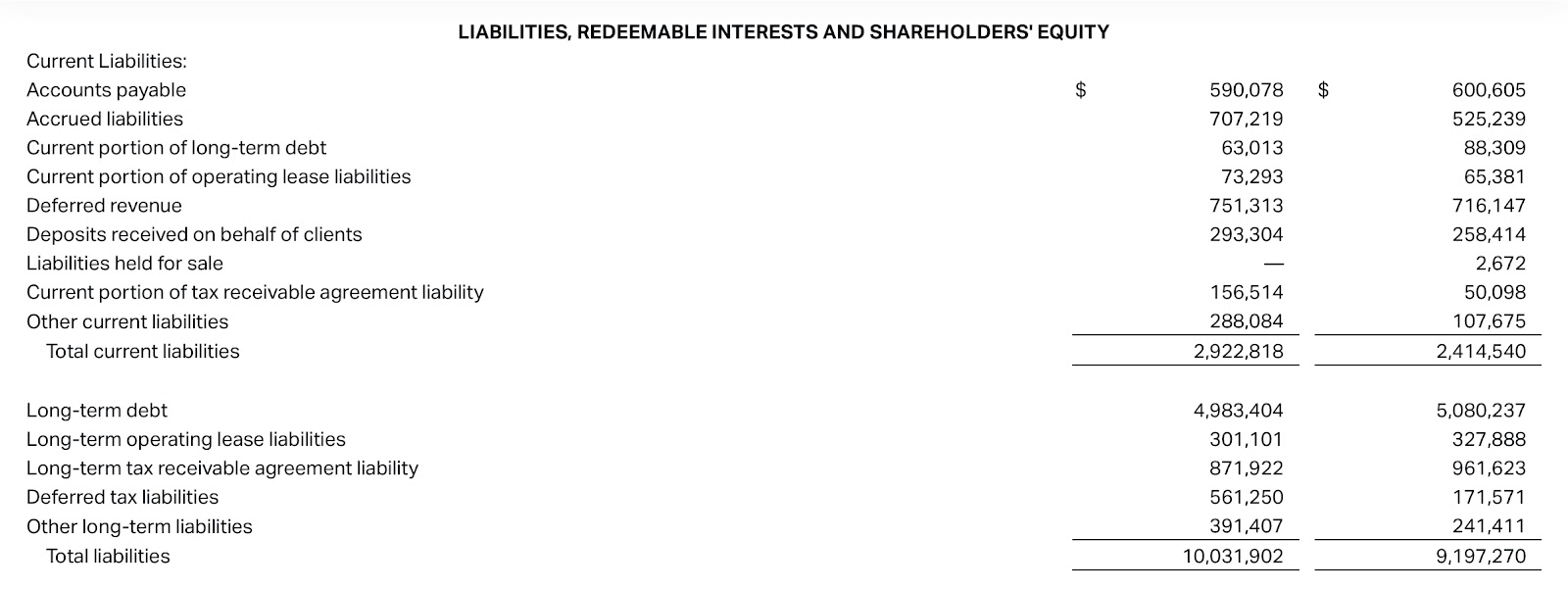

Let’s look at the liabilities. There are $10bn of which $3bn are current.

So the net book value of EDR (assets less liabilities) is thus $11bn, of which goodwill is $10bn.

Move on quickly.

Let’s see if EDR makes money?!

I mean, real money, not what the creative accountants say.

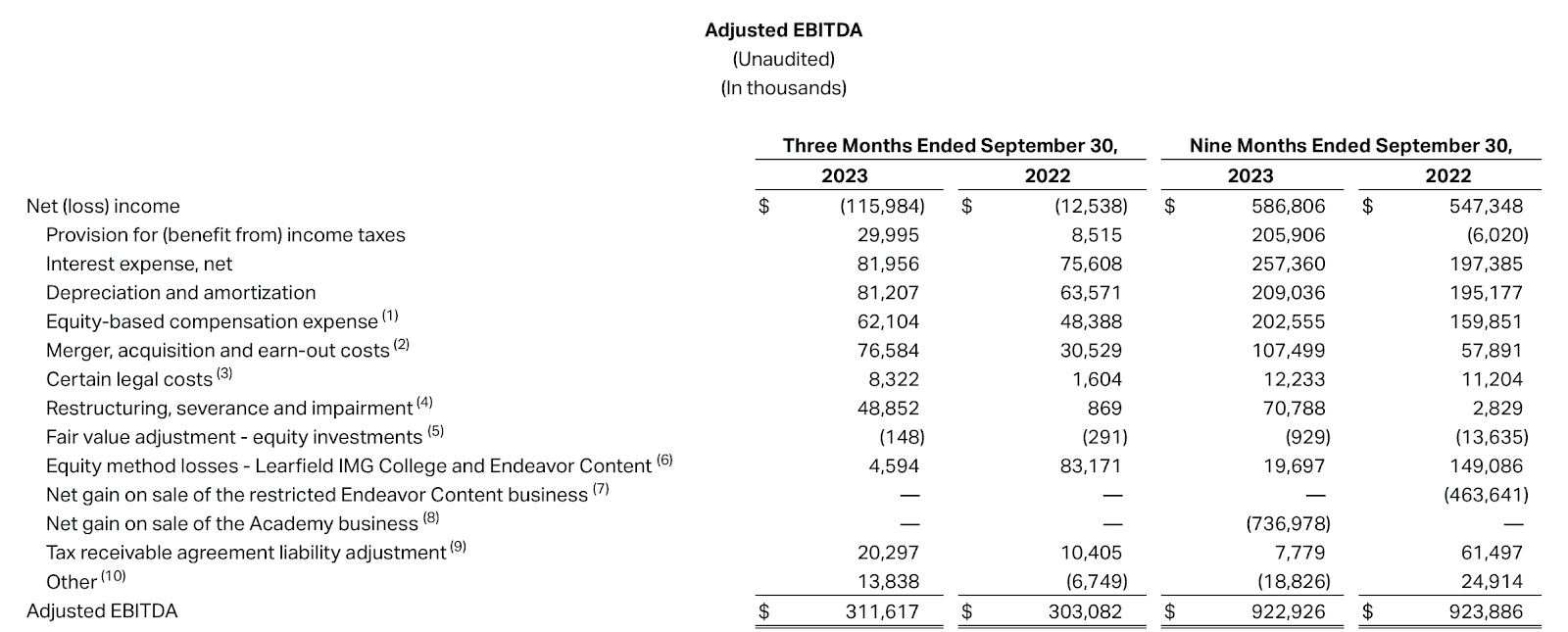

The thing to look at is the difference between the real profit figure and adjusted EBITBA. In there you will find most of what you need to know about the task at hand. The mood music of the numbers, the art!

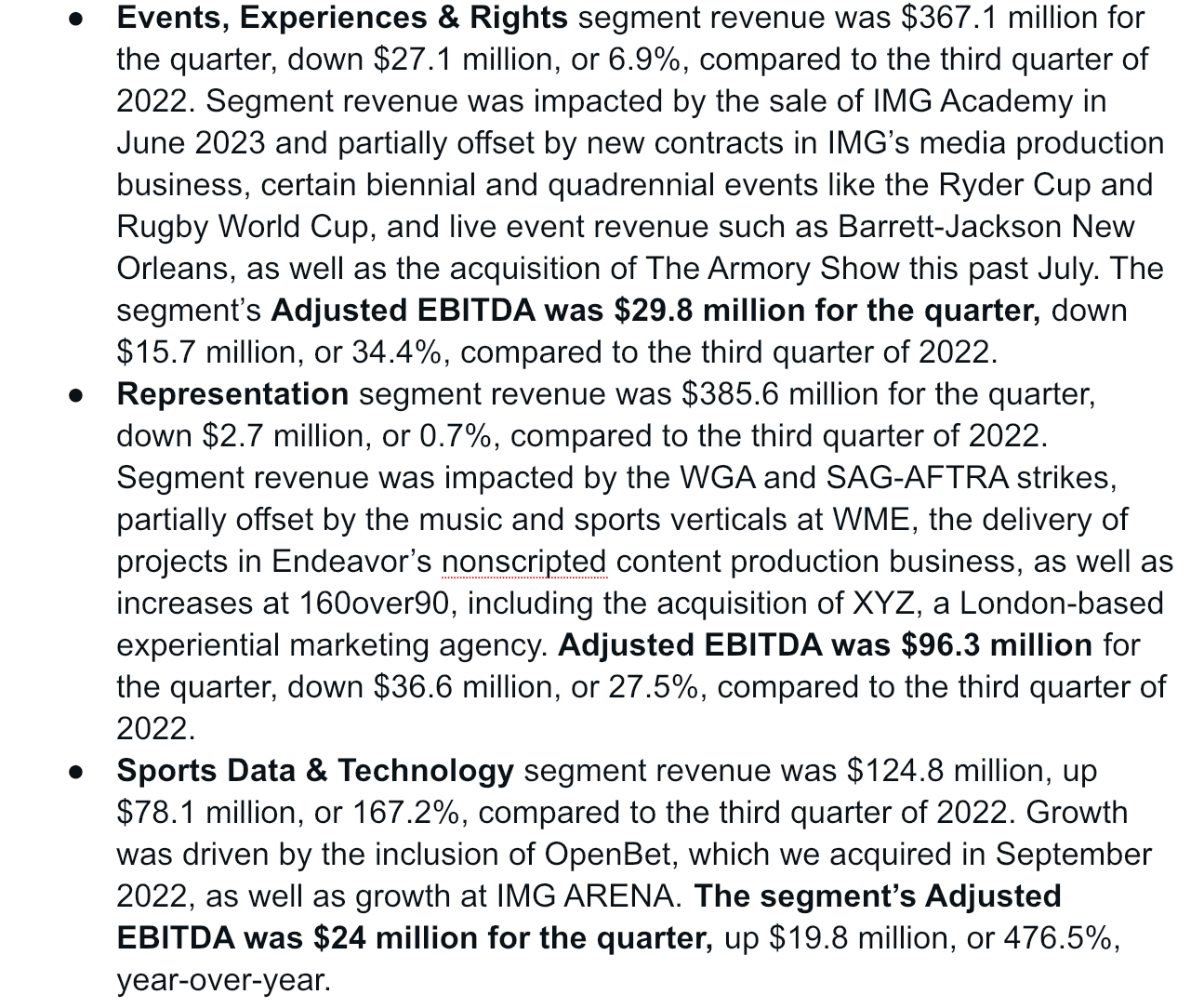

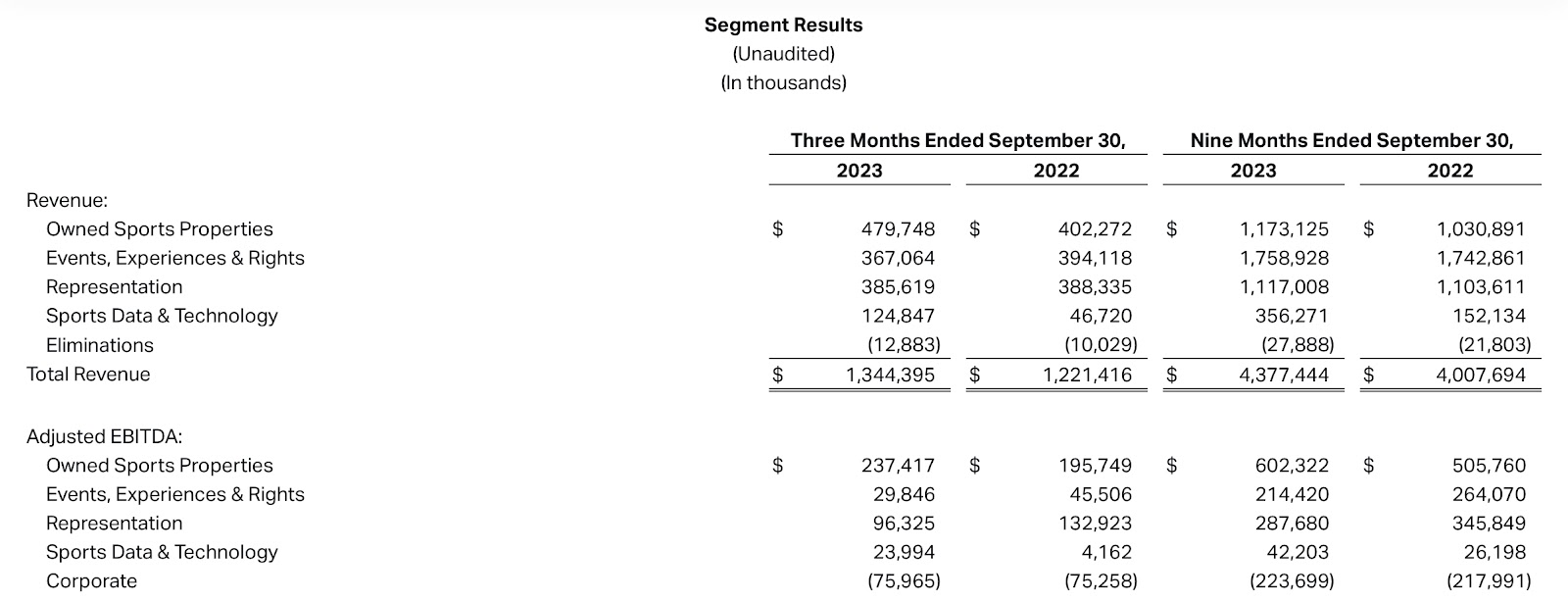

Here is the latest quarterly report from EDR.

The Q3 adjusted EBITDA profit is $311m, the real loss is $116m.

Cough!

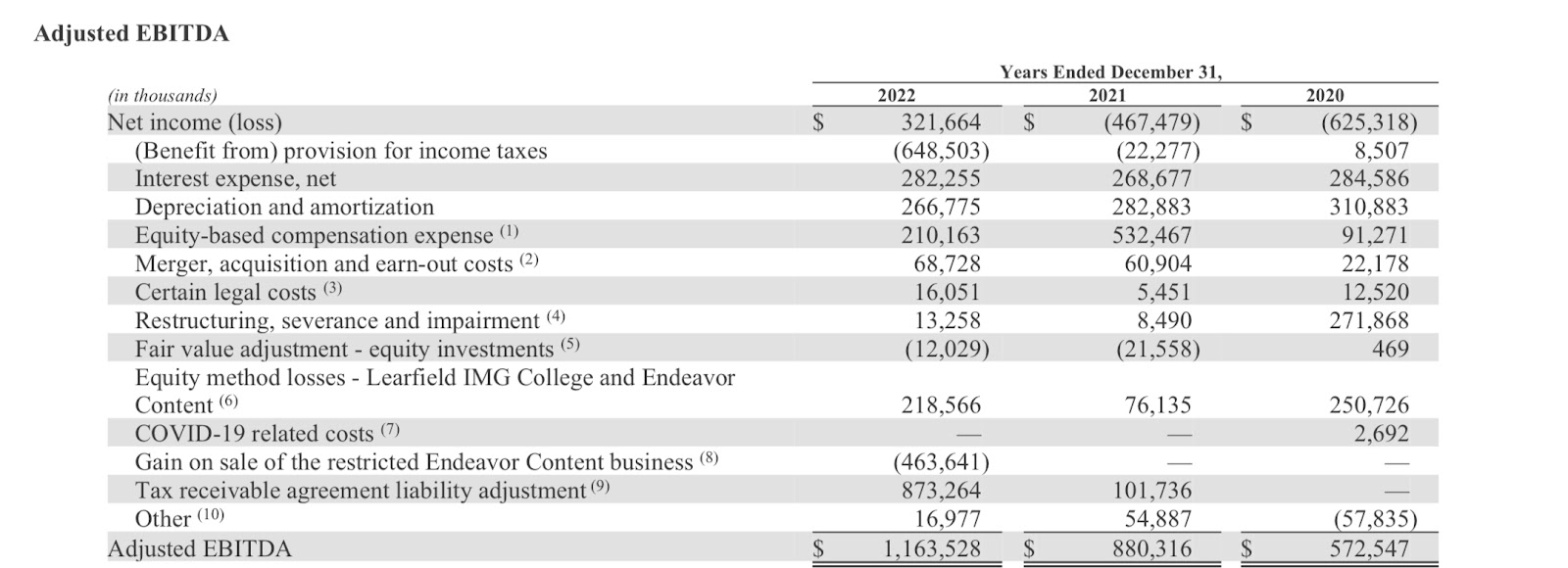

Maybe, this was just a strange year, and let’s not jump to conclusions. We need to look at the full annual results for the last three years for a better view.

Welcome to the murky world of finance. It is no wonder that the already-missed Charlie Munger called adjusted EBITDA “bullshit earnings”.

Here, they are massively different from real Net Income every single year.

This isn’t just an EDR thing; it is, sadly, how my profession now works, to my shame. It removes really important stuff like share-based compensation, earn-outs, restructuring costs, impairment, all to below the line, and there is SO much scope for creative accounting, even for a mediocre CFO.

But let me say this again, EDR is doing nothing wrong. This is the game.

If you don’t wanna play that way, don’t play that way.

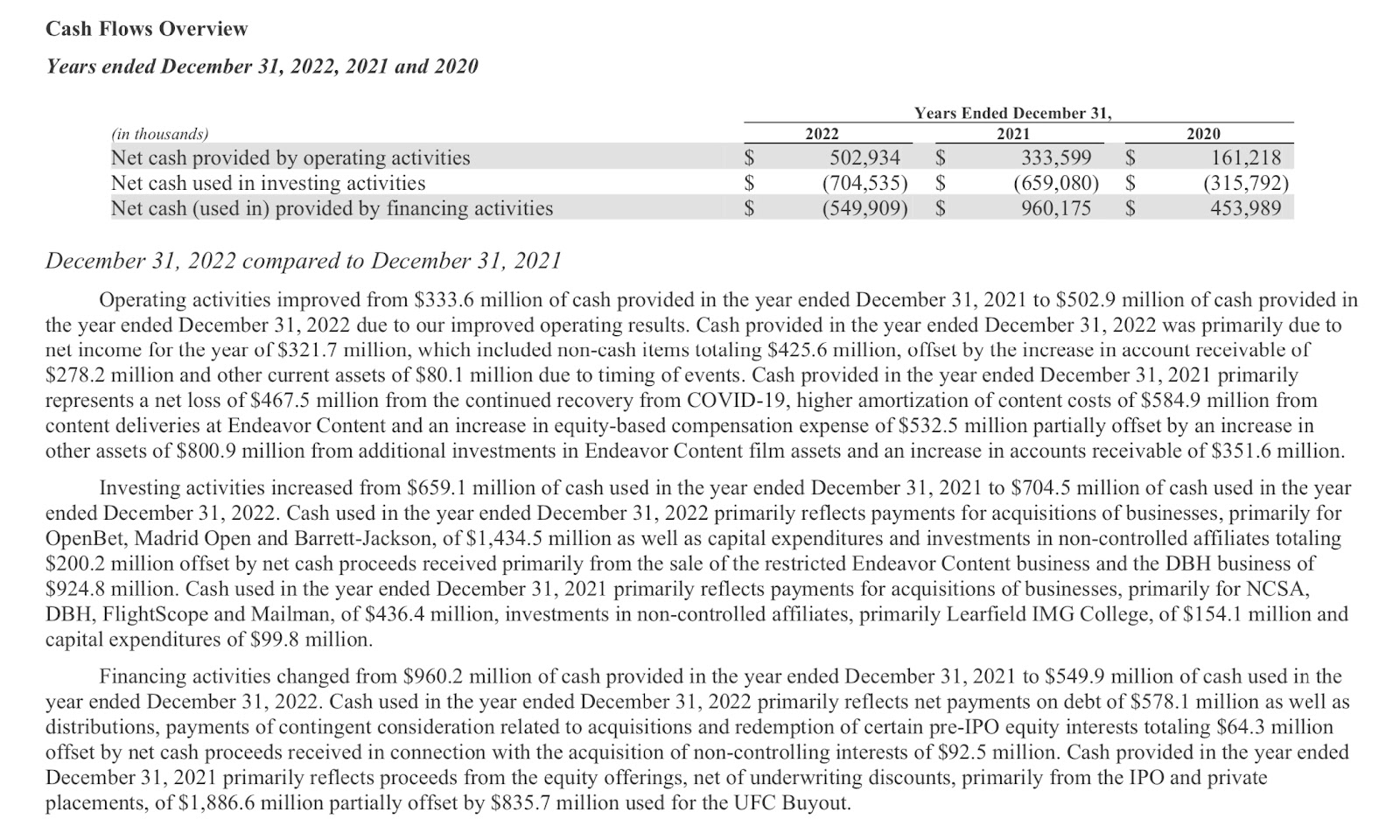

Ok, since we’ve given ourselves a wee bit of concern, let’s check out the cash flow.

Revenue is vanity. Profit is sanity. Cash is reality.

Buried deep in the annual report, on page 72 of the notes, is the cash flow statement.

In summary, the EDR group in 2022 threw off $503m of cash from operations, compared to the above $1.16bn of adjusted EBITDA. Add in the $1.25bn of cash out for buying companies and paying down debt, and EDR burned $722m of cash in 2022.

Cough! Not necessarily bad, given what they’ve been buying.

At this point, we know what the numbers were hoping to tell us, but also the reality.

You sure you don’t need “Sport’s Perfect Storm“?😉

EDR today is valued at $11.5bn, and that’s actually pretty close to book value.

Let’s look at other common methods of valuation. Companies can be valued in a variety of different ways, all of which give context.

1) Value as a multiple of earnings. The Price Earning (PE) multiple.

Most financial websites gives EDR a forward PE multiple of 39, you get your money back on the purchase price after about 40 years.

According to classic value investing parameters of Ben Graham, Buffett, and Munger, that is eye-wateringly high. Martin Sorrell never bought such expensive companies. The only saving grace is that the research shows that the rest of the sector is valued similarly.

Additionally, if you can’t nail the real “earnings” with confidence, especially when we’ve seen that adjusted EBITDA is unreliable, what is a PE valuation really worth?

It doesn’t really matter here, and this is what you’d tell your boss about undervaluation.

I can’t get comfortable that EDR is undervalued at 39x.

2) Value by the Discounted Cashflow (DCF) Model.

This method looks at the future cash the business will throw off and discounts it back by a predetermined cost of capital.

As “Storm readers” now know, the DCF valuation is utterly dependent on the risk/BETA you use on the discount rate, and the Terminal Valuation assumptions. In today’s disruptive media markets, that’s a finger in the air, to be frank.

In researching this article I looked at various stock analysis sites of repute, and found a gigantic disparity in the DCF valuations they gave for EDR. Goodness, even they can’t agree amongst themselves. For those so minded, here is a site from where to calculate the DCF with your own assumptions. Note how the valuation changes when you increase the discount rate or lower the Terminal Value.

DCF is whatever you want it to be. One can get to any number, if truth be told.

For curiosity, I worked backwards and noted that the current market valuation of $11.5bn equated to a 11% discount rate. Not so high.

For the boss,

I would conclude, once again, that I can’t get comfortable that EDR is undervalued at a 11% cost of capital.

3) Value by Market Comparatives and Recent Deals.

The market price is what someone is actually prepared to pay for something, and is a very hard datapoint.

EDR owns a company, with a realtime actual market valuation, called TKO (UFC and WWE). It’s listed on the market and valued at $14.8bn today. So, the 51% owned by EDR is worth $7.5bn.

65% of EDR (old IMG) is now TKO, an IP business owning cage fighting and fake wrestling. Arnold Palmer no more.

So clearly how we materially respond to the brief depends on how we view TKO, and where we think the share price will go. It has dropped 15% since listing.

“Tell me something I don’t know, Buddy“.

Opinion is why your boss is paying you a salary, and hasn’t yet replaced you with a robot.

Surprise them with colour and conviction. This is where talent and experience counts.

It is hard to argue that most of the good news about TKO isn’t already in the market.

The Smackdown/NBC deal, Raw/Netflix, are done, and one needs to ask what new news can still come out to move the share price? A better network deal? Renegotiating of the Peacock deal? Better sponsorship?

Hard to see major needle-moving deals not already in the price, but there are synergies.

EDR says the deal will result in an estimated $50 million to $100 million in annualized run-rate cost synergies, including by moving WWE to EDR’s back-office infrastructure.

We built UFC using the Endeavor flywheel across a myriad business verticals, including sponsorships, media rights licensing, and event operations expertise. That same recipe will be applied now. WWE social is phenomenal. The merger will see a best-in-class merging of social teams and across sponsorships which allows us to maximize revenue potential.

– Mark Shapiro, Endeavor.

Well, he would say that, wouldn’t he?

A good analyst would counterbalance that, highlighting the risk that the Saudis are building a serious MMA competitor to the UFC, and that fighters’ compensation will need to rise, eating margins. This circus-type sports event is exactly the profile in the sights of SRJ and PIF.

The market currently values TKO at about $15bn, and we will take that as money-good for now.

Which means the rest of EDR is worth $4bn (11.5bn less TKO at 7.5bn).

Is that undervalued for all those other assets? It feels like it, but the actual financial performance from Q3 2023 informs us.

Adjusted EBITDA, from non-TKO businesses, totals about $150m from these numbers. But we know that EBITDA is always overstated, and there is also $76m of group central overhead in Q3, as we can see below.

Given all this, it’s reasonable to suggest a sustainable earnings figure for non-TKO businesses at $100m per quarter, $400m profit for a full year. Likely optimistic.

Compared to the implied valuation of those divisions at $4bn, that seems fair. A multiple of 10x real earnings.

So with the TKO market valuation at $7.5bn, plus $4bn for the rest, this could be argued to be actually pretty accurate.

I would conclude, even here Boss, that EDR doesn’t seem outrageously undervalued.

But what do actual market deals in the sector tell us about the value of everything outside TKO?

In September 2023, Pinault agreed to buy control of EDR’s competitor, CAA, at a valuation of $7 billion. Based on that price, Sportico suggests that Endeavor’s player and artists representation businesses should be worth about $5 billion by itself.

Here, for the first time, we can smell something that resembles “undervaluation”.

”Tell me something I don’t know Buddy, surprise me!”

- Pinault is married to Salma Hayek, a CAA client, and we can guess that she can be very convincing in certain moments! He perhaps overpaid to “own” his wife?

- Any talent business is based on the juicy margins from bundling talent, and that’s now always going to be under legal attack.

In 2019, the Writers Guild of America (WGA) filed a lawsuit against the four major Hollywood talent agencies, including WME, Creative Artists Agency (CAA), United Talent Agency (UTA), and ICM Partners, over their usage of packaging deals (under which a talent agency offers a production utilising its represented writers, directors, and/or actors as a “package” to prospective studios), which the WGA asserted to be an illegal conflict of interest under state and federal law.

- Any business broking humans in the content industries must have risk, when all we read is how it can all now be done by AI, creating digital actors and influencers that work just as well.

So, whilst Sportico says this division of EDR is worth $5bn, I am taking the under, at $4bn, even without a deep dive on the annual reports of CAA and WME.

At this point, on this basis, TKO and the talent business now add up to close to $11.5bn, the valuation of the whole group today.

You are getting the rest for free.

…

Your boss is waiting for a reply.

You had a day, and time is running out, so you start bringing your thinking to a summary.

I’d suggest it goes something like this:

Reality Valuation

If TKO can hold its value, then the market is currently valuing the rest of the EDR group at only $4bn. On a good day, with trophy buyers looking at sexy Hollywood actors at WME, you’d get $4bn for the talent division alone. It maybe isn’t intrinsically worth $4bn, but in these markets it will fetch that at least.

So you are getting the rump of EDR, the old IMG business, for free and, if this is the upside, here is my view on all that.

Great brand, great clients, but it’s all heavy on minimum-guarantee capital, and bundling isn’t as easy anymore. Private equity buyers in sport think they can take all the intermediary work and margin in-house, so selling services to sport is now a slog. The rights holder clients have a long sales cycle, are very political, and never want to pay you fully. You have very little pricing power. The actual earnings numbers for these businesses from the Annual Report look a bit thin at best.

On the plus side, there are so many middle-tier sports rights holders that now need a full- service partner for their commercial side, like Rugby League.

The sports production side of IMG maybe isn’t such a high margin business anymore, and painfully competitive, but guys like Barney Francis are top class and per se create value.

The digital agency business, old Seven League, doesn’t seem to make much money, and is certainly not so well considered by many, but it rounds out the 360 degree product offering of this division. 160 over 90, a company specialising in PR and advertising for entertainment and experiential events is a nice fresh asset. I’d think to merge those two businesses.

IMG Arena, the data/betting business is maybe number 3 in this space. All these companies are killing themselves overpaying for the data rights of big leagues, and strategic M&A would suggest consolidation. Arena has the advantage of Openbet synergies in theory, and is a good asset. It could be punted to Genius or Radar.

Endeavor acquired 80% of OnLocation, the NFL-founded entertainment and events business, for $660 million in 2020. That has value for sure.

It paid $800 million last year for OpenBet.

Based on the purchase prices of OnLocation, and Openbet, and with the great IMG brand and client base, I think you could look to get $1-2bn for all this, subject to full due diligence, so I’d calculate that the total break-up value of EDR is TKO 7.5bn, Talent 4bn, the rest 1.5bn. Total 13bn.

That translates to around $28 a share compared to $25 today. You’d need to offer a takeover premium for a formal bid, so there isn’t a lot of upside that I see Boss. It’s marginal.

Sexed-up Valuation

TKO worth $9bn once synergies kick in; $5-6bn for the talent side for the Salma Hayek premium, and $4bn for the rest. You’d talk up Arena/Openbet as a play on the opening US betting market. Total $19bn.

They could even spin off IMG into a separate listed vehicle, like they did with TKO. Or flip it to someone like a Two Circles, who seem to need to go big on M&A. Or even to Saudi, who would love the credibility of the brand.

So I can make a case for $20bn total value without looking too silly. Boss, I’m sure I can stand up an overall EDR valuation of $40 a share pretty easily.

What will Ari do?

Fees are good in getting deals done in M&A, so which version of the summary valuation do you think gets more exposure?

In my humble opinion, Silverlake will make a full bid for EDR at around $30 per share, and Emanuel and Whitesell will recommend that bid to shareholders.

They, likely, will not break it up, as Ari is an empire-builder who likes power, and Silverlake has said publicly that it likes the flywheel of the conglomerate.

They may rearrange all businesses outside talent under the old IMG brand, as it is still the best in the sportbiz, and currently under-exploited within EDR.

“Lloyd, who is that Scotch nobody piece of shit? I want his book now. I am gonna fuck him up so bad. How dare he?”

To order the Limited Edition of Roger Mitchell’s book “Sport’s Perfect Storm“, click here and fill the form.

Listen to our “Are you not entertained?” sports management podcast here.

To find out what we do in change management, have a look here.

For our C-suite management services, read here.

Here you can know more about our content development work.

Discover our Corporate Learning service.

Get to know more our “Sport Summit Como” yearly sports management event here.

If you are interested in our own story, check us out here.