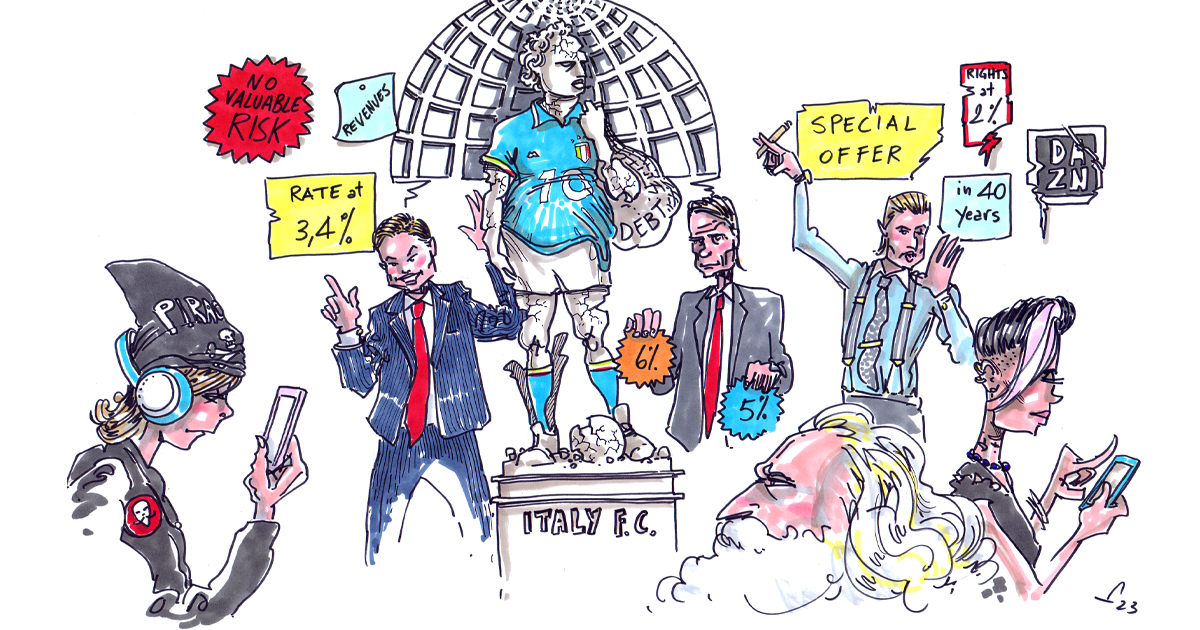

It’s been a humbling week for Italian football on various fronts.

The scandal enveloping Juventus, and other clubs, around false accounting threatens a 2006 Calciopoli redux for the industry of soccer in the Bel Paese. Some people would like to see the Turin club, a listed company, once again sent down a division for their sins of gaming their numbers around wages and false player trading gains. Conspiracy theorists suggest that Gravina, head of the Italian FA, is taking direct orders from Ceferin. He wants the blue blood of Agnelli, who doesn’t have his troubles to seek, as we previously chronicled in this Column.

But the most chilling and tragic example is that of the multi-titled and genuinely glorious AC Milan being financially outbid by Bournemouth,(with all due respect), for the services of Roma player Zaniolo.

This is a world upside down. A glitch in the Matrix.

DAZN, the main broadcaster here, betting on the attraction of the media rights in Italy, is losing bucket loads of cash. Their ongoing commitment must be in question. Especially at that price!

Sampdoria apparently has to find €11m immediately to avoid going bust.

Italy hasn’t qualified for the last 2 World Cups and has on the surface stopped producing the type of talented players that made their brand of football one of the great schools of the game. The divine Roberto Baggio blames the proliferation of very average foreign players, as a blockage to the progress of good Italian talents (that still exist) stuck in the lower divisions. “When I was young, the only foreign players in Italy were top top notch. Each club could only have 3″.

These are sad and volatile times for the whole sector of pallone in Italy.

Isn’t all this an obvious example of an asset in decline?

And yet, and yet, we are told that the league, Serie A, is fielding a multiple selection of bids from financial institutions, who all want to lend against the asset. Indeed, last year, they also received a similar bid from private equity company CVC.

Curious.

Aren’t we told that Big Finance is very clever and informed about the assets against which it invests? The smart kids in the room?

What are they thinking? What is going on? Are they backing the wrong collateral for their capital, or are they shrewdly vulture investing in a fire sale, into a desperate host, in need of any kind of solution?

Without knowing the details of the bids, it’s foolish to opine with conviction. I just don’t have the numbers and spreadsheets. So let’s talk in generality. That still works.

So, let’s assume that Big Finance isn’t stupid. (As a parenthesis, they did a lot of very stupid things in 2006/7. Always, when money is basically free, malinvestment is just around the corner.)

“Nothing sedates rationality

like large doses of effortless money”

– Warren Buffett.

If Big Finance is bringing its A game to these deals, that leaves the idea that Serie A, and La Liga, Ligue 1, are doing bad business.

This article will look at both sides of the trade.

What drives smart people to make bad financial deals? In my experience it is often when people have been backed into a corner, and strategically snookered. When the wolf is at the door.

Why are European soccer and rugby leagues taking money from Big Finance? There has been a plethora in recent years.

What are they trying to achieve? Are they making good deals for their sport?

A question asked by Nick Meacham, one of the best commentators himself and with his SportsPro Media masthead.

Firstly let’s explain what they are doing as a term sheet.

In the case of Serie A, with the interest from Goldman, JP Morgan, et al,

They are basically selling the family silver (future media revenues) in exchange for a wedge of money up front.

This type of thing isn’t new. Sport has done it for ages. In its most basic description, this is merely invoice factoring. They’ve been selling forward sponsor and player trading invoices for years.

Big Finance can structure these deals in various ways:

- An equity investment. Ownership in some kind of vehicle that owns a league’s media rights.

- A loan, debt, against the collateral of future media rights. With repayment of capital and interest into the future.

Equity capital is however very different to taking debt capital. CVC thinks about deals (in sport) from a different perspective. They feel they can add operational value.

But whichever way you cut it,

Big Finance is taking a view, a bet, on the stability

AND GROWTH of future media broadcast rights.

And applying a finance cost (discount rate) for giving their money up front. Different from factoring, we as yet don’t know what the exact quantum of future invoices for Serie A media rights will be years into the future.

As someone who has run a league, and knows how those shareholder clubs think, and act, I struggle to come up with a worse idea than selling your future revenues and prosperity to merely put more money into the hands of clubs for today.

Why? Because clubs are hugely indisciplined in their husbandry of resources. And the temptation to use that money to (over)pay for playing talent, TODAY, is overwhelming.

We are, and will always be, told that this is the wrong take, and that the monies from selling the silver is for capital investment. Digitalisation, new stadia, women’s game, DTC strategies etc. Investment that will have a long-term return. Readers of this article will tell me that there are fixed limits on players expenditure, that in Spain, the CVC money is already going to the right projects. And in theory, In Italy, eventually to stadia. God knows Italian football needs modern stadia. But, ask them all, the Pallottas, the Commissos, the Milan clubs, how politically easy that is.

So, to use an Italian word to describe the whole “money for investment” idea: CAZZATE.

It’s BS. Window-dressing. Narrative.

The reason they really want the money is mentioned at the start of this article.

- Strategically, they can no longer compete with EPL clubs and they need more firepower for players. To compete with a Bournemouth.

- They are cash poor, illiquid, insolvent. In simple terms… BUST.

There is some precedent in the sports sector by now, on all this. Most famously, the CVC investment into rugby. What was the plan there? The justification? How is that working out? May I ask, what has rugby done with CVC’s money? Anyone seen progress?

Some friendlies rebranded, the cliched Netflix series of course, trying to organise the global rugby calendar, but, in the trenches, clubs are going bust. That’s reality.

If you read articles like this, you can see CVC has misread the value of broadcast rights and central revenues in rugby.

Leagues should IMHO not be doing these deals.

Sport already has a horrendous problem with short termism, and minimum guarantee mentality.

Both often driven by the need for instant success, and fan pressure for results this Saturday. It’s a very tough gig. No value judgement on owning a football club.

“How do you make a small fortune? Start with a big one and invest in a football club”

So these deals for me are like giving a junkie 10 bags of cash with the request that they go and get a hot meal. You know what is really going to happen… that fresh wedge is going where it has always gone… on players and agents. Call me cynical.

Big Finance doesn’t necessarily care, especially if it is structuring its capital as debt. It’s Shylock. Either way, it is getting a pound of flesh. It may even have offloaded the debt to some other sucker by now. That’s often what happens.

This clip is the cold, ice cold, reality of finance, proving the point.

Sell it all… today!

Big Finance will always do what it needs to do. Sport is merely an asset class, a cashflow stream, a loan book.

There are, however, other practical realities around why these deals are hugely problematic in open leagues.

A league today is pledging the future revenues of tomorrow’s league for many years; 50 years in the CVC la Liga deal. But tomorrow’s league will likely have different shareholders. Clubs get promoted, others drop out. Can you imagine you finally get promoted to the big league. And you think that finally you can get your hands on the big TV monies, but when you get there you’re told: “eh, actually we have sold those rights a long time ago. And the monies went to the clubs in the league at the time”. I don’t hear this talked enough. It’s, I humbly suggest, a huge issue.

So I am pinning my flag to this opinion:

These deals are a very bad idea for sport.

They are not the solution for European football leagues trying to compete with England.

Loading European soccer up with debt is not dealing with the real problem. The real problem is that the EPL is running away. It’s already out of sight. That’s a structural problem. Debt won’t solve that.

But are these deals working for the providers of capital. The PE funds and banks?

Let’s look at the guts of the corporate finance thinking of these deals. Finance and risk is so poorly understood in this industry. Sure, some podcasts on accounting, articles on how Chelsea can fit into FFP via ammortization. That’s not finance. Accounting isn’t finance.

The basic principle of finance is that

you invest in something that rewards you enough to compensate you for the risk of the asset.

If you are putting in equity, and valuing a business, then you have to discount the future cashflows of that business by an interest rate big enough to compensate you. This will be called Economic Value Added (EVA) in the best books.

If you are lending debt, you need to charge an interest rate big enough to cover you for the risk of not getting paid back.

As said above, all these sports deals have one asset, one revenue stream, as collateral. Future media rights.

How does CVC, as our best example of equity investors, assess media rights?

Well, they pay a lot of money to ask real experts. Boutique research houses and consultancies. They will then look to invest with good timing, when markets are soft, and they will actively expect to improve the values over 3 rights cycles. As a sidebar, one of the ways they think they can get better margins is by simply eliminating the middle man, the media agencies. How many times have you heard Infront, Mediapro or even IMG talking up PE investment in sport? No shit, Sherlock.

In rugby, in this first rights cycle, CVC hasn’t made progress, and is in trench warfare with rugby politics. Next year will be a big test for them as the second cycle starts. Third cycle is maybe when they get a return?

The reality is that the rights landscape is now full of volatility (a financial first cousin of risk).

Risk is not being properly priced in sport.

IMHO, nowhere close.

And the chickens will come home to roost for many.

Identifying, pricing, and mitigating risk is what finance, not accountancy, is all about. I’ll add in the use of debt to lever returns, to complete the description. I will not complicate matters here (my finance book will come later), but PE funds make so much of their returns with the use of Archimede‘s lever of debt.

Give me a firm place to stand and a lever and I can move the Earth.

Risk, however, is not all the same everywhere. Certainly not in sport.

To make an example:

American sports franchises are not as risky as European sports clubs for a couple of big reasons:

- No relegation

- Salary caps

- Cities that buy you a stadium

- Long-term more secure broadcast deals

We now have an MLS club valued at $1bn.

None of these advantages apply to European football clubs, in Spain, in Italy, in Germany. And leagues in Europe have their big clubs always looking to elope to a superleague. Risk on risk.

How should you price that risk? Are the deals we are seeing pricing it correctly?

Let’s look at what happened in Spain with football.

Who did the smartest deal in corporate finance terms ?

CVC

La Liga

Barcelona FC

Sixth Street

The answer is like the Chinese reply to their view on the French Revolution:

Too early to say.

As mentioned, I don’t have the full details, but I have enough to conclude that:

It all depends on what happens to broadcast rights in Spain. That’s the punt!

Let’s do some numbers…

Sixth Street has paid €523m for 25% of Barça’s broadcast revenues till 2047. Barça made €166m in 2021 from its share of La Liga TV rights. It’s usually about 11/12%. (P.S.: Barça generates much much more than 11% of the total value of Spanish football, and this will not hold going forward. Hollywood and Arthouse. Arbitrage will have its day.)

In the below article by Off The Pitch, they make a calculation of the annual notional interest cost incurred by Barca, depending on how broadcast revenues grow.

If rights value stays constant, it works out at 6%pa, if rights rise 5% a year, it works out at 11%.

NOTE, LADIES AND GENTLEMEN, THAT THERE IS NO SCENARIO FOR RIGHTS VALUES TO GO DOWN.

Not even considered.

In a sports league that has lost the presence of two contending GOATs for a decade (Messi and Ronaldo), that has an uncertain landscape on possible bidders for rights, that hasn’t yet seen cord cutting and piracy kick in, that has GEN Z less interested in TV…

Why, on God’s green earth, does no-one think sports rights can go down?

I am not saying it is your base case, but it needs to be a scenario, no?

My own expected middle scenario would be rights to stay stable, and hence the cost of capital for Barça is 6% a year, each year to 2047.

And here comes the crux of all this hot air.

The takeaway of this article of mine: 6% is cheap money!!!

It maybe wasn’t a year ago, certainly not two years, but today it’s very cheap. American government debt, the 10 Treasury bond, is today yielding 3.4%. That is considered the safest debt in the world, the risk-free rate. So, if lending risk-free costs 3.4%, then you expect me to lend to the basket case that is Barcelona for only 2.6 extra points? Are you insane?

Interesting, OffThePitch considers 6% expensive. They comment how other clubs are paying a lot less in their borrowings. I disagree with a passion.

Arsenal, Spurs, Liverpool, Barcelona, Real Madrid they say are all paying between 1.5 – 3% on their senior debt.

Deals done in a different world, I’d retort.

You know what that tells a good corporate financier?

That when it comes to refinancing that debt, as Inter Milan did a year ago, the cost is going way up. A year ago, Inter rolled over half a billion dollars in debt, guaranteed by its media rights. The credit rating of the club was downgraded B+ “junk”. It’s now paying close to 7%.

Trust me, in 2023, the proper cost of capital (equity or debt) for Spanish or Italian football clubs with their risk is not 6%. And 2% is long gone; yesterday’s wet dream. It’s going north.

Let’s come back to Inter. As stated, it has already mortgaged its media rights at club level. And the club debt is considered very risky at B+. And now the club’s league, Serie A, is going to do something similar at a league level. Folks, that’s called a second mortgage. How much debt can one revenue stream service? How many people do you know with a second mortgage who end up ok? How much discounting, bank and financing charges, can Italian football sustain? Anyone heard of the terms “debt trap“, “debt spiral“, “debt overhang”?

European soccer soon will!

So, if you are at JPM, or Goldman, what kind of deal are you offering Serie A, to compensate you enough for the specific risk and volatility of Italian football, the market macro risk of Italy, and an increase in interest rates? What discount rate should one use to apply to future TV revenues in Serie A? What discount rate did Redbird apply to AC Milan cashflows?

Whatever it is, I’ll stick my neck out and say it’s not enough.

Given a risk free rate of 3.4%, the country risk of Italy, the shambles of governance that is Serie A, the Juve scandal and their desire to leave, the volatility of DAZN, piracy, inflation and energy cost,

I’m not lending to Italian football for anything less than 15%. On a generous day.

Probably, why I don’t work in these fields. I couldn’t keep my mouth shut. And juicy fee earning deals wouldn’t get done.

So, your petty and ill-informed author here concludes that these deals are bad for the sport body borrower (who will take all that money and indulge his/her addiction), but also bad for the Big Finance lender (who is not getting enough return for the risk being taken on the asset).

With one proviso: where do broadcast rights go? We saw the model above. If Spanish rights grow 5%pa, the return is 11%. Getting better. Still not enough for me, but better.

You can boil so many of these deals in sport down to this. Are broadcast rights going up. Who knows? As Matthew McConnaughey says, I don’t care if you’re Warren Buffett, Jimmy Buffett… no one knows if sports rights are going up, down or sideways.

The truth will out on those deals many years in the future. We will all be doing different jobs. But today, these billion dollar debt deals earn a LOT of commission and fees.

Welcome to Wall Street.

Listen to our “Are you not entertained?” sports management podcast here.

To find out what we do in change management, have a look here.

For our C-suite management services, read here.

Here you can know more about our content development work.

Discover our Corporate Learning service.

Get to know more our “Sport Summit Como” yearly sports management event here.

If you are interested in our own story, check us out here.